Follow Us

- Indian Army Thwarts Pakistan's Attempts To Attack Military Bases, Tensions Escalate Between the Two Nations

- Indian forces repels Pakistan's 8 missiles and drones, intercepted by S-400 defence system

- Blood donation camp organised at Congress Bhawan

- Congress to organise Tiranga Yatra to support armed forces

- India thwarts Pak missile attack on 15 sites; launches drone strikes, neutralises air defence in Lahore

Budget 2024: New income tax slabs announced,TDS increased

However, the government was also expected to increase the exemption in the old tax regime, but the government has kept distance from changing it. In the new tax regime, the limit of standard deduction has been increased from Rs 50,000 to Rs 75,000. With this, now the common man's income of Rs 7.75 lakh has become tax free effectively.

The government has changed the tax slab in the new tax regime, that is, now in the new tax slab, there will be zero tax rate on income up to Rs 3 lakh. This is the same as before. Now, income from Rs 3 to 7 lakh will be taxed at the rate of 5 percent. Earlier this tax slab was Rs 3 to 6 lakh.

Similarly, the government has changed the income tax slab of Rs 6 to 9 lakh to Rs 7 to 10 lakh. The tax rate on this will be 10 percent. At the same time, tax will be levied at the rate of 15 percent on income of Rs 10 to 12 lakh, 20 percent on income of Rs 12 to 15 lakh and 30 percent on income of more than Rs 15 lakh. Apart from this, it was announced in the budget today to increase TDS from 10 percent to 14 percent, that is, now the salaried person will get 4 percent less money every month.

Upon adopting the old tax regime, income up to Rs 10 lakh can be tax free, whereas in the new tax regime, only income up to Rs 7 lakh is zero tax. Actually, in the old tax option, by including the deduction of 87A, income tax is not payable on income up to Rs 5 lakh annually. If your annual income is between Rs 5 lakh and Rs 10 lakh, then you will be taxed up to 20%. That is, you will have to pay tax of Rs 1,12,500.

But there are many such provisions in the Income Tax Act, i.e. tax exemptions, through which you can make income up to Rs 10 lakh tax free. According to chartered accountants, if you invest in EPF, PPF, Equity Linked Savings Scheme, Sukanya Samriddhi Yojana, National Savings Certificate, 5-year FD, National Pension System and Senior Citizen Saving Scheme, then you can get tax exemption.

You will have to invest a maximum of 1.5 lakh in any one of these or in several plans. If you have done this, then now subtract 1.50 lakh rupees from 10 lakh rupees. Now the income coming under the tax ambit will be 8.50 lakh rupees. You can save tax up to 1.5 lakh under section 80C of income tax. Apart from this, you can also save tax through home loan and medical policy.

If you have taken a home loan, then you will save tax up to 2 lakh rupees, the expenditure on medical policy will also be tax free, if you are a senior citizen then this saving is up to 50 thousand rupees, but if your age is less than 60, then you can save 25000 rupees. In such a situation, now the income will be 5.50 lakh rupees. On the other hand, you can get a tax exemption of 50 thousand by investing in the National Pension System, that is, now the income will be 5 lakh rupees.

Taking advantage of Section 87A of Income Tax, if you deduct Rs 5 lakh from your income of Rs 10 lakh, then your taxable income will be Rs 5 lakh. In such a situation, now you will have to pay zero tax on this Rs 5 lakh.

Indian Army Thwarts Pakistan's Attempts To Attack Military Bases, Tensions Escalate Between the Two Nations

India thwarts Pak missile attack on 15 sites; launches drone strikes, neutralises air defence in Lahore

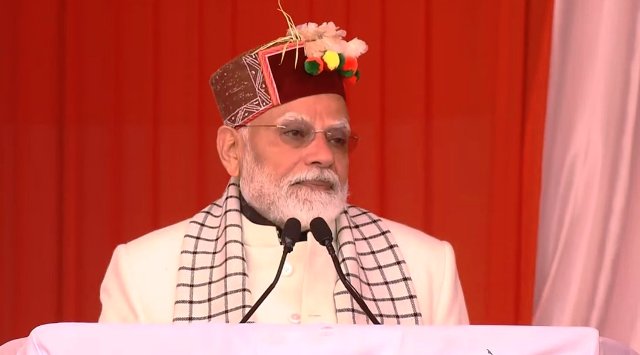

PM Modi Chairs High-Level Meeting with Secretaries of Government of India

At least 100 terrorists killed as India airstrikes Pakistan under 'Operation Sindoor', Rajnath tells all-party meet

India Destroys Pakistan’s Air Defense System in Lahore Using Israeli Drones

-

.jpg)

Indian Army Thwarts Pakistan's Attempts To Attack Military Bases, Tensions Escalate Between the Two Nations -

Indian forces repels Pakistan's 8 missiles and drones, intercepted by S-400 defence system -

India thwarts Pak missile attack on 15 sites; launches drone strikes, neutralises air defence in Lahore -

PM Modi Chairs High-Level Meeting with Secretaries of Government of India -

.jpg)

At least 100 terrorists killed as India airstrikes Pakistan under 'Operation Sindoor', Rajnath tells all-party meet -

India Destroys Pakistan’s Air Defense System in Lahore Using Israeli Drones -

Pakistan's Lahore rocked by serial blasts, eyewitnesses claim missile attack, airport shut down -

.jpg)

India’s Airstrike Causes Devastation in Pakistan:90 Terrorists Killed, Several Terror Camps Destroyed -

India Airstrikes Terror Camps in Pakistan Occupied Kashmir Under 'Operation Sindoor',Destroyed 9 Terrorist Hideouts -

BJP’s Anti-Women Mindset Exposed by Women Themselves: Akhilesh Yadav -

.jpg)

Kharge claims ‘intel report’ was sent to PM Modi 3 days before Pahalgam attack -

(1).jpg)

PCC chief calls for protection to Indian constitution -

.jpg)

Pahalgam Attack: India Halts Chenab River Water Flow from Baglihar Dam -

.jpg)

Pakistani Ambassador Threatens India, Says Nuclear Weapons Will Be Used if Attacked -

.jpg)

Pahalgam attack: US Secretary of State Rubio spoke to Foreign Minister Jaishankar and Pakistan Prime Minister

.jpg)

.jpg)

.jpg)

.jpg)