Follow Us

- Raja Raghuvanshi Murder Case: Wife Sonam Kills Husband During Honeymoon

- Congress claims PM Modi lacks courage to face direct press questions

- Pallahara village stuck by alarming tick (tinka) problem

- Cabinet Expansion in Telangana: Three Congress MLAs Inducted into Revanth Reddy’s Ministry

- Trump Deploys National Guard to Curb Protests As Violent Clashes in Los Angeles

Finance Minister Sitharaman tables new Income Tax bill in Lok Sabha

The legislation will replace the Income Tax Act, 1961, which has undergone extensive modifications over the past six decades.

The bill will be sent to the Select Committee of Parliament before being presented for final approval. The new law is expected to take effect on April 1, 2026.

The primary objective of the new Income Tax Bill is to simplify tax laws, making them more transparent, easier to interpret, and taxpayer-friendly. By replacing complex provisions with clearer language, it aims to reduce legal disputes and encourage voluntary tax compliance.

The bill may introduce lower penalties for certain offences, making the tax system more accommodating for taxpayers.

The new bill also introduces explicit provisions for virtual digital assets and updates beneficial tax rates. This ensures that digital assets, such as cryptocurrency, are covered under a proper tax framework.

The bill will not alter existing tax slabs or revise the tax rebate structure. Instead, it focuses on making the six-decade-old legislation more user-friendly.

“This reform is a significant step toward modernizing India’s tax framework, bringing greater clarity and efficiency. The bill promises a more streamlined, accessible tax system, making it easier for citizens and businesses to fulfill their obligations while fostering trust in the system,” said Rohinton Sidhwa, Partner, Deloitte India.

The first part of the Budget Session of Parliament concluded on Thursday, with the second part scheduled to resume on March 10. The session is being held in two phases—January 31 to February 13 and March 10 to April 4.

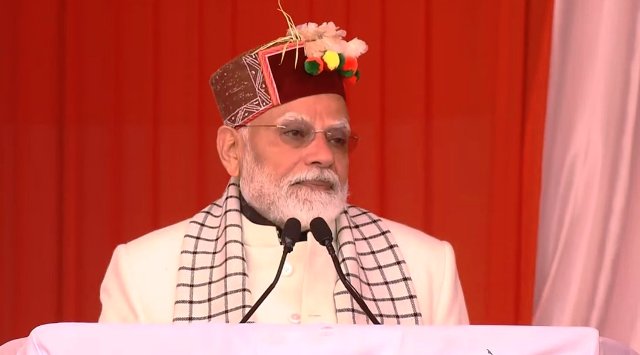

PM Modi outlines 5 key global priorities to strengthen Disaster Resilience

India's foreign exchange reserves fell by $4.89 billion to $685.73 billion

NALCO CMD focuses on completion of strategic project expansions

NALCO Clocks Net Profit of Rs. 5325 crores with Revenue from Operations at Rs. 16, 788 crore in FY25

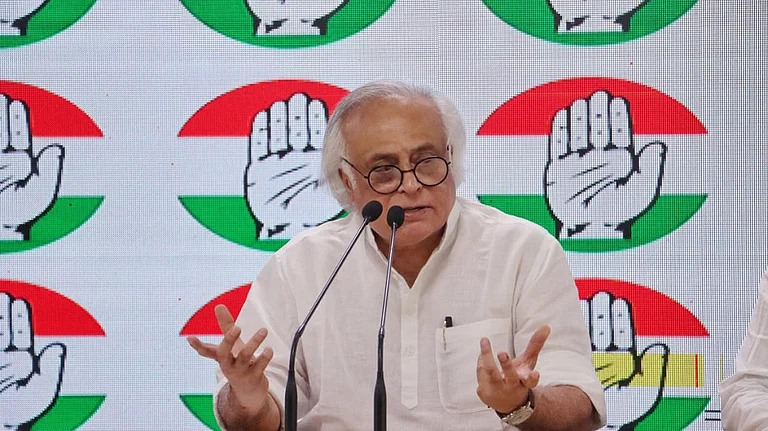

Double Engine Modani Saga Continues : Congress

-

Congress claims PM Modi lacks courage to face direct press questions -

Colombian Presidential Candidate Shot in Head, Condition Critical, Attacker Arrested -

Trump Extensively Used Emergency Powers in Second Term -

Internet suspended in 5 Manipur districts, situation worsens after Meitei leader’s arrest -

'Double Engine' Government Only Emitting Smoke : Sachin Pilot -

Bihar has become the crime capital of India : Rahul Gandhi -

Elon Musk suggests floating new political party amid rift between Trump -

TMC MP Mahua Moitra marries BJD leader Pinaki Mishra abroad -

.jpg)

Congress Accuses BJP Government of Protecting Criminals -

.jpg)

Bihar: Outrage Erupts in Muzaffarpur Over Minor Girl’s Murder, Congress Holds 'Halla Bol March' in Patna -

Self-Proclaimed supreme leader and master distorter Distorting Facts Engaged in Anti-Nehru Campaign -

‘Undeclared Emergency’: Congress on 11 years of Modi govt -

OPCC President demands resignation of Railway Minister over tunnel collapse -

Trump Threatens 25% Import Duty on iPhones If Not Made in US -

Congress Slams PM Modi Over Silence on Trump's Statement On Investment Landscape

.jpg)

.jpg)

.jpg)

.jpg)