Follow Us

- Centre Suggests Only Two Tax Slabs of 5% and 18%, Many Items May Become Cheaper

- Congress attack's Modi's I-Day speech, calls it stale, hypocritical and insipid

- 'Vote chor, gaddi chhod': Cong stages protest across India against alleged discrepancies in voter list

- Congress Welcomes Supreme Court’s Decision on SIR, Vows to Protect Voting Rights

- Jammu and Kashmir: 38 Dead, Several Missing, 120 Rescued in Kishtwar Cloudburst

Centre Suggests Only Two Tax Slabs of 5% and 18%, Many Items May Become Cheaper

The revised system is expected to be implemented by Diwali this year.

According to high-placed sources, the Centre has sent this proposal to the Group of Ministers (GoM) formed to rationalize GST rates, eliminating the existing 12% and 28% tax slabs.

Under the proposed revised GST framework, apart from the two tax slabs, a special 40% rate has been suggested for luxury and demerit goods.

The GoM will now discuss this proposal and present its recommendations to the GST Council, which is expected to meet next month.

Currently, essential food items are taxed at 0%, daily use items at 5%, standard items at 12%, electronics and services at 18%, and luxury or demerit goods at 28%.

Sources indicate that in the revised framework, set to replace the existing indirect tax system by Diwali, only two tax rates—5% and 18%—have been proposed.

Once the GST Council, the highest decision-making body for GST matters, approves this proposal, 99% of items currently under the 12% slab will shift to the 5% slab. Similarly, around 90% of goods and services currently taxed at 28% will move to the 18% slab under the new system.

Sources revealed that the special 40% tax rate will apply to only seven items. Tobacco products will also fall under this rate, but the total tax burden will remain at the current 88%. Online gaming, considered a demerit product, is also proposed to be taxed at 40%.

An official source stated that the revised GST structure is expected to boost consumption significantly, which could offset any revenue loss from the rate changes.

The source expressed optimism about the system being implemented by the start of the third quarter, saying, “The change in tax rates will impact revenue, but the shortfall is expected to be compensated within a few months.”

Introduced on July 1, 2017, the current GST framework merged central and state levies. Under this indirect tax system, the 18% tax slab contributes the highest share, accounting for 65% of GST collections.

The 28% rate, applied to luxury and demerit goods, contributes 11%, while the 12% slab accounts for only 5% of revenue. The lowest 5% rate, applied to essential daily-use items, contributes 7% to total GST collections.Sources noted that high labor-intensive and export-oriented sectors like diamonds and precious stones will continue to be taxed at rates aligned with the current structure. Under the GST Act, the maximum tax rate on any good or service is capped at 40%.

Priyanka Gandhi condemns the killing of journalists by Israel in Gaza

16 killed, 8 injured in paramilitary forces attack in W. Sudan

Israel Considers Full Control Over Gaza Amid Military and Public Concerns

Trump Administration Targeting India Through Tariffs: Expert

Trump Threatens India Again To Significantly Increase Tariffs on India in the Next 24 Hours'

-

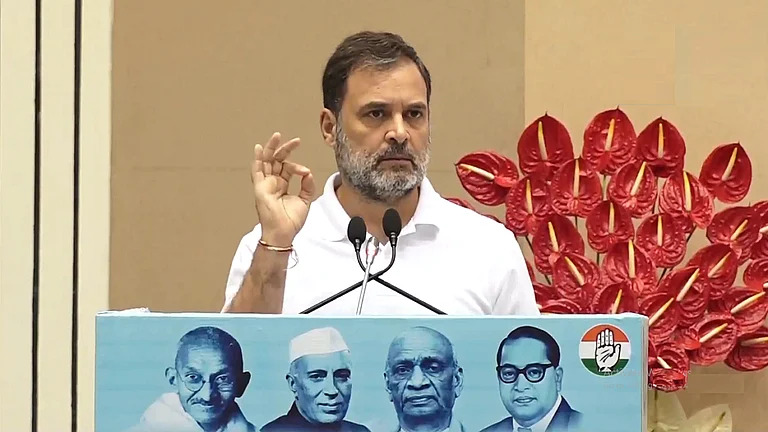

Congress attack's Modi's I-Day speech, calls it stale, hypocritical and insipid -

Congress Welcomes Supreme Court’s Decision on SIR, Vows to Protect Voting Rights -

Jammu and Kashmir: 38 Dead, Several Missing, 120 Rescued in Kishtwar Cloudburst -

Rahul Gandhi Slams BJP Over Missing Thousands of Forest Rights Titles in Chhattisgarh -

.jpg)

Bihar SIR: Singhvi and ADR Raise Questions on Election Commission’s Process, ECI to Respond Tomorrow -

.jpg)

Bihar SIR: Rahul Gandhi Meets 'Deceased' Voters Over Tea -

.jpg)

Priyanka Gandhi condemns the killing of journalists by Israel in Gaza -

Kharge: Government has stolen votes, discussion on SIR must in Parliament -

Election Commission Removes 334 Unrecognized Political Parties from Registration List -

.jpg)

Sharad Pawar Supports Rahul Gandhi on Voter List Concerns -

.jpg)

‘Vote Theft’ an Atom Bomb on Our Democracy, Rahul Gandhi’s Revelations Raise Questions on Election Commission’s Credibility -

Uttarkashi Relief and Rescue Operations Continue : Over 400 People Evacuated, 9 Army Personnel Among Missing -

Israel Considers Full Control Over Gaza Amid Military and Public Concerns -

Cloudburst in Dharali Affects Army's Harsil Camp, Several Soldiers Missing, Rescue Efforts Underway -

.jpg)

Trump Administration Targeting India Through Tariffs: Expert

-

.jpg) Congress to Hold Massive Protest in Bengaluru on August 5 Against Vote Rigging, Rahul Gandhi to Participate

Congress to Hold Massive Protest in Bengaluru on August 5 Against Vote Rigging, Rahul Gandhi to Participate.jpg) Rahul Gandhi Claims Rigging in Around 100 Lok Sabha Seats in 2024 Poll

Rahul Gandhi Claims Rigging in Around 100 Lok Sabha Seats in 2024 Poll 'The Election System in the Country is Dead',Says Rahul Gandhi

'The Election System in the Country is Dead',Says Rahul Gandhi Security Forces Neutralize One Terrorist in Kulgam Encounter

Security Forces Neutralize One Terrorist in Kulgam Encounter -

NIA arrests one more key accused in 2024 brutal murder case in Manipur’s Jiribam

NIA arrests one more key accused in 2024 brutal murder case in Manipur’s Jiribam US President Trump Makes Big Claim Again, Says: 'Heard India Will No Longer Buy Oil from Russia, This Is a Good Step...

US President Trump Makes Big Claim Again, Says: 'Heard India Will No Longer Buy Oil from Russia, This Is a Good Step... Draft Voter List Released in Bihar After SIR, Nearly 65 Lakh Names Removed, Highest Cuts in Patna

Draft Voter List Released in Bihar After SIR, Nearly 65 Lakh Names Removed, Highest Cuts in Patna New US Tariffs to Hurt India’s Exports! Will MPC Meeting Lead to Interest Rate Cuts?

New US Tariffs to Hurt India’s Exports! Will MPC Meeting Lead to Interest Rate Cuts?

.jpg)

.jpg)

.jpg)