Follow Us

- Panic In Ahmedabad As Elephant Goes Berserk During Rath Yatra

- Congress Targets RSS Over Call to Review Preamble Words, Says Their Thinking is Anti-Constitution

- Navy Employee Vishal Leaks Operation Sindoor Details to Pakistan, Arrested from Jaipur

- Stock Market Closes Strong for Third Consecutive Day, Sensex Surges by 1,000 Points

- BJP Uses Constitution to Gain Power, Forgets to Respect It Once in Power: Akhilesh Yadav

Stock Market Closes Strong for Third Consecutive Day, Sensex Surges by 1,000 Points

- Market strength leads to investors earning ?3.44 lakh crore in a single day

(Fast Mail):-- Due to easing geopolitical tensions and strong global cues, the domestic stock market managed to close with gains for the third consecutive day on Wednesday. The market opened strongly, but in the initial minutes, there was slight selling pressure. However, buyers soon took charge. After 10 AM, sellers attempted to create pressure again, but post 1 PM, widespread buying began. Supported by this buying, the stock market surged by approximately 1.25%. After a full day of trading, both the Sensex and Nifty closed with a 1.21% gain.

Throughout the day, there was significant buying in energy, banking, and FMCG sector stocks. Additionally, metal, oil and gas, public sector enterprises, automobile, capital goods, consumer durables, healthcare, and tech indices also closed with gains. However, the IT sector faced selling pressure. The broader market saw consistent buying, leading to the BSE Midcap Index closing 0.56% stronger, while the Smallcap Index ended the day with a 0.12% gain.

The market’s strength today resulted in a nearly ?3.5 lakh crore increase in investors’ wealth. The market capitalization of companies listed on the BSE rose to ?457.45 lakh crore (provisional) after today’s trading, up from ?454.01 lakh crore on the previous trading day, Wednesday. This translates to a profit of approximately ?3.44 lakh crore for investors.

During the day’s trading, 4,153 stocks on the BSE saw active trading. Of these, 2,097 closed with gains, 1,900 saw declines, and 156 closed unchanged. On the NSE, 2,600 stocks were actively traded, with 1,337 closing in the green and 1,263 in the red. Similarly, among the 30 Sensex stocks, 21 closed with gains, while 9 ended lower. Of the 50 Nifty stocks, 42 closed in the green, and 8 in the red.

Similarly, the NSE Nifty opened 24.20 points higher at 25,268.95. Early selling pressure caused it to dip to 25,259.90, but buyers then dominated, pushing the index up by 173 points to 25,417.75 by 10 AM. After a brief dip due to profit-booking, aggressive buying resumed post 1 PM, driving the Nifty to 25,565.30, a gain of 320.55 points. However, late selling due to trade settlements caused it to slip 16.30 points from its peak, closing 304.25 points higher at 25,549.

After the day’s trading, top performers among major stocks included Shriram Finance (4.16%), Jio Financial (3.03%), Hindalco Industries (2.67%), Tata Steel (2.65%), and Adani Ports (2.60%). On the other hand, Dr. Reddy’s Laboratories (-1.50%), Tech Mahindra (-0.87%), Hero MotoCorp (-0.53%), Maruti Suzuki (-0.41%), and State Bank of India (-0.37%) were among the top losers.

Govt forms panel to probe plane crash, asked to submit report in 3 months

PM Modi outlines 5 key global priorities to strengthen Disaster Resilience

India's foreign exchange reserves fell by $4.89 billion to $685.73 billion

NALCO CMD focuses on completion of strategic project expansions

NALCO Clocks Net Profit of Rs. 5325 crores with Revenue from Operations at Rs. 16, 788 crore in FY25

-

Panic In Ahmedabad As Elephant Goes Berserk During Rath Yatra -

.jpg)

Navy Employee Vishal Leaks Operation Sindoor Details to Pakistan, Arrested from Jaipur -

.jpg)

U.S. President Trump Signals Softening Stance on Iran, Makes Statement on Iranian Oil and China! -

.jpg)

Pakistani Officer Who Captured Indian Air Force Pilot Abhinandan Killed in Taliban Attack -

.jpg)

Trump to send Ukraine more Patriot missiles after meeting Zelenskiy -

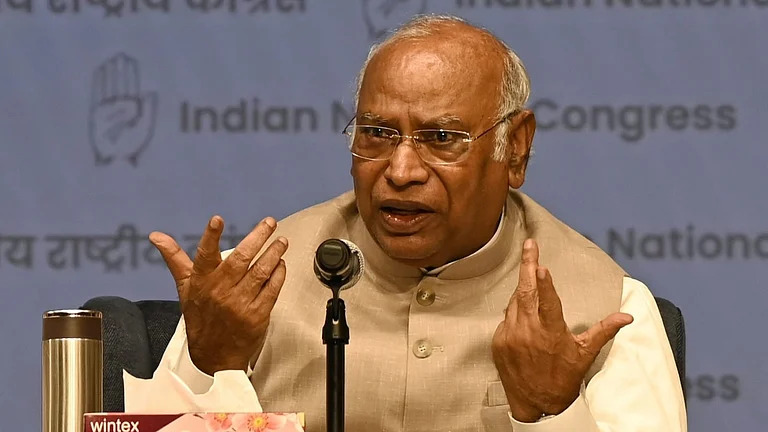

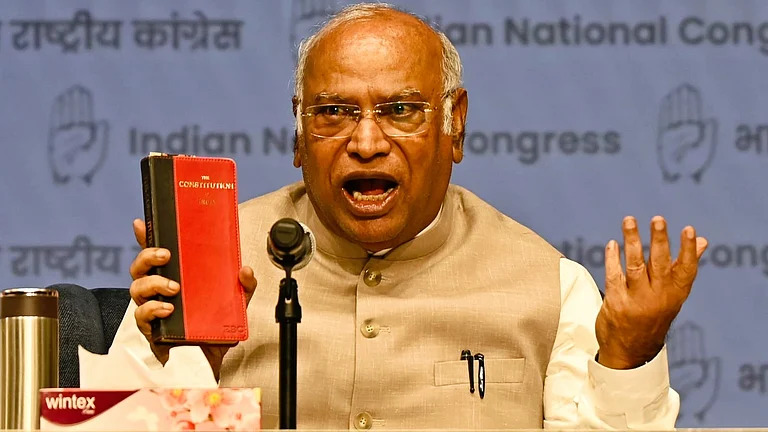

Election Commission has become a puppet of Modi govt : Kharge -

BJP staging drama to cover up government's failures : Kharge -

PM Modi hails successful launch of space mission carrying astronauts from India, Hungary, Poland, and the United States -

Axiom-4 Mission Launched: Shubhanshu Shukla Sent Message From Space;Says 'Entire India Is with Me' -

.jpg)

France condemns Israeli strikes on civilians at Gaza aid distribution center -

25 Killed, Over 100 Injured As Israeli Army Opens Fire on People Waiting for Aid in Gaza -

.jpg)

'BJP's politics based on hatred and discrimination, Rahul Gandhi on Odisha Dalit youths 'torture' -

Two Dalit Men in Odisha Tonsured, Assaulted, Congress Forms Probe Committee -

(2).jpg)

Iran-Israel war: Israel says Iran launched more missiles despite truce -

.jpg)

Iranian Missile After US Attack Causes Heavy Destruction,Over 40 Missiles Fired

-

Chaos in Several Israeli Cities: 10 Dead, Over 200 Injured In Iranian Missile Attacks! Scenes of Destruction Everywhere

Chaos in Several Israeli Cities: 10 Dead, Over 200 Injured In Iranian Missile Attacks! Scenes of Destruction Everywhere.jpg) Iran Fires Ballistic Missiles, Widespread Devastation In Israel

Iran Fires Ballistic Missiles, Widespread Devastation In Israel NEET UG 2025 Results Declared: Rajasthan’s Mahesh Keswani Tops, Madhya Pradesh’s Utkarsh Avadhiya Secures Second Place

NEET UG 2025 Results Declared: Rajasthan’s Mahesh Keswani Tops, Madhya Pradesh’s Utkarsh Avadhiya Secures Second Place PM Modi to visit Republic of Cyprus,Canada and Croatia from 15-19th June, 2025

PM Modi to visit Republic of Cyprus,Canada and Croatia from 15-19th June, 2025 -

Priyanka Gandhi slams Modi govt for abstaining from UN motion on Gaza

Priyanka Gandhi slams Modi govt for abstaining from UN motion on Gaza UN Security Council meets in emergency session after Israel-Iran conflict escalates

UN Security Council meets in emergency session after Israel-Iran conflict escalates.jpg) Congress Criticizes Home Minister on Ahmedabad Crash: 'Promise Accountability, Not Lectures on Fate'

Congress Criticizes Home Minister on Ahmedabad Crash: 'Promise Accountability, Not Lectures on Fate' One year of BJP rule in Odisha is a year of misrule,deception and arrogance : Congress

One year of BJP rule in Odisha is a year of misrule,deception and arrogance : Congress

.jpg)

.jpg)

.jpg)