Follow Us

- Victory of nationalistic ideology,says President-elect C P Radhakrishnan

- Sudarshan Reddy : I Humbly Accept the Outcome, Ideological Struggle Will Continue

- Nepal Army Takes Control, Curfew in Kathmandu, Airport Closed, Flights Suspended

- Sudarshan Reddy on Vice Presidential Election Results: I humbly accept the outcome, ideological struggle will continue

- CP Radhakrishnan to be the country's Vice President, receives 452 votes, Sudarshan Reddy gets 300 votes

ITR verification: Income tax issues alert,do this important work today itself

The Income Tax Department tweeted, 'Dear taxpayers, complete the e-filing process today itself! Please see below how to e-verify the return. Remember to verify your ITR within 30 days of filing it. Delayed verification may attract late fee as per the provisions of the Income Tax Act, 1961. Don't delay, verify your ITR today!'

E-verification is mandatory for the ITR to be considered valid. Effective August 2023, the Income Tax Department has made it mandatory for tax filers to e-verify their returns within 30 days of filing returns.

Go to the e-filing portal of the Income Tax Department. Click on 'e-verify return'.

You will be required to enter your PAN, the assessment year for which the verification is being done (2023-24) and the acknowledgment number.

Alternatively, you can also log in with your PAN and password. Go to 'My Account' and then click on 'e-Verify Returns'.

New page will open and it will show, for which your verification is pending.

The process of verification through Aadhaar OTP is quite straightforward. One can use the OTP received on the mobile number registered and mapped with Aadhaar to verify and e-verify the return.

Indian Rupee Hits Record Low Against US Dollar, Gold and Silver Reach New Peaks

India’s GDP Growth Sparks Enthusiasm, but Contradictions Sound Warning Bells

Akhilesh Yadav's Attack on PM Modi's China Visit: Claims Chinese Goods Harm Indian Businesses and Jobs

American Tariffs Threaten 10 Lakh Jobs in India, Major Sectors to Face Severe Impact

Congress demands official paper on GST 2.0, calls for 'Good and Simple Tax'

-

.jpg)

Nepal Army Takes Control, Curfew in Kathmandu, Airport Closed, Flights Suspended -

.jpg)

Sudarshan Reddy on Vice Presidential Election Results: I humbly accept the outcome, ideological struggle will continue -

.jpg)

CP Radhakrishnan to be the country's Vice President, receives 452 votes, Sudarshan Reddy gets 300 votes -

Nepal PM KP Sharma Oli Resigns Amid Escalating Violence, Protesters Set Parliament Building on Fire -

Tejashwi Accuses PM Modi of 'Double-Character',Says BJP Concocting Ploys to Divert Attention from Vote Theft -

.jpg)

Mahadevapura was just an atom bomb, now get ready for a hydrogen bomb : Rahul Gandhi -

Prime Minister of Yemen’s Houthi-run government killed in Israeli strike -

Dragon and Elephant Must Come Together : Xi Jinping -

.jpg)

PM Modi Held Bilateral talks with Xi Jinping -

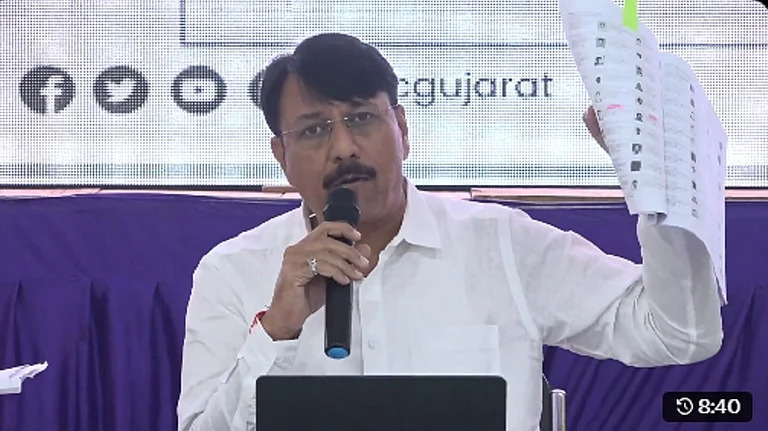

Gujarat Congress Accuses BJP of ‘Vote Theft,’ Claims 12.3% Fake Voters Found in Union Minister’s Constituency -

Bihar's 'Voter Adhikar Yatra' Concludes: Rahul Gandhi Says, 'This Theft is Not Just of Votes, But of Rights' -

PM Modi's 'Mega' Partnership Formula Has Become a Headache for India,Says Congress -

.jpg)

American Tariffs Threaten 10 Lakh Jobs in India, Major Sectors to Face Severe Impact -

.jpg)

Khamenei Rejects Direct Talks with Washington,Says Iran Will Not Bow -

Threat of 'Kajiki' Looms Over Laos After Devastation in China

-

.jpg) Congress to Hold Massive Protest in Bengaluru on August 5 Against Vote Rigging, Rahul Gandhi to Participate

Congress to Hold Massive Protest in Bengaluru on August 5 Against Vote Rigging, Rahul Gandhi to Participate.jpg) Rahul Gandhi Claims Rigging in Around 100 Lok Sabha Seats in 2024 Poll

Rahul Gandhi Claims Rigging in Around 100 Lok Sabha Seats in 2024 Poll 'The Election System in the Country is Dead',Says Rahul Gandhi

'The Election System in the Country is Dead',Says Rahul Gandhi Security Forces Neutralize One Terrorist in Kulgam Encounter

Security Forces Neutralize One Terrorist in Kulgam Encounter -

NIA arrests one more key accused in 2024 brutal murder case in Manipur’s Jiribam

NIA arrests one more key accused in 2024 brutal murder case in Manipur’s Jiribam US President Trump Makes Big Claim Again, Says: 'Heard India Will No Longer Buy Oil from Russia, This Is a Good Step...

US President Trump Makes Big Claim Again, Says: 'Heard India Will No Longer Buy Oil from Russia, This Is a Good Step... Draft Voter List Released in Bihar After SIR, Nearly 65 Lakh Names Removed, Highest Cuts in Patna

Draft Voter List Released in Bihar After SIR, Nearly 65 Lakh Names Removed, Highest Cuts in Patna New US Tariffs to Hurt India’s Exports! Will MPC Meeting Lead to Interest Rate Cuts?

New US Tariffs to Hurt India’s Exports! Will MPC Meeting Lead to Interest Rate Cuts?

.jpg)

.jpg)